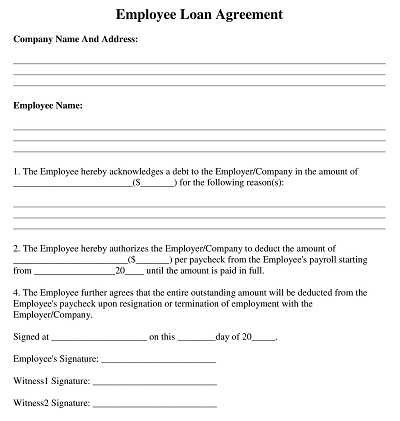

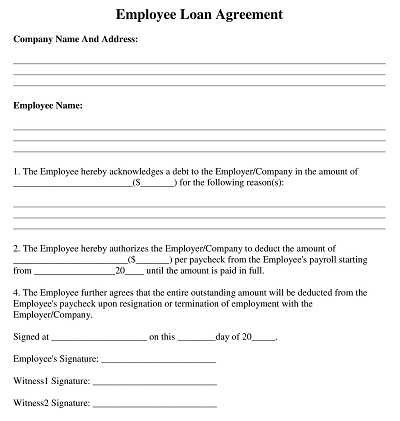

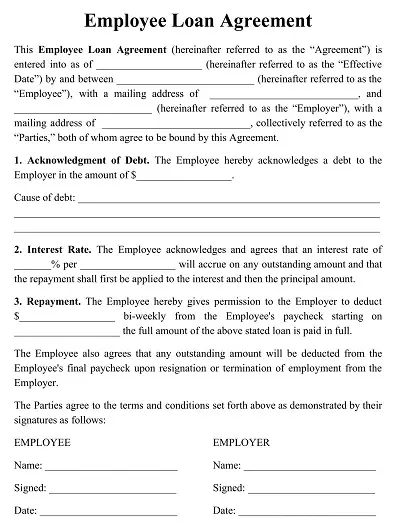

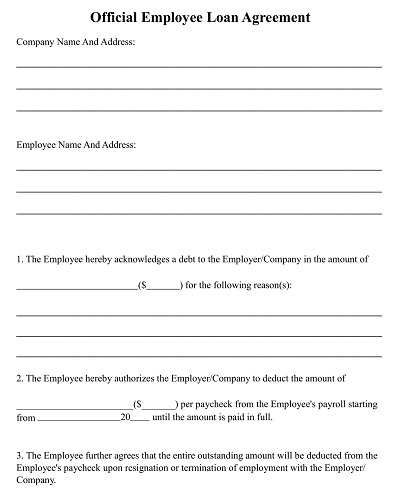

An employee loan agreement template is a legal document that outlines an agreement between an employer and an employee for a loan to be provided. It includes details on the loan amount, terms and conditions, repayment period, interest rate, due dates, and other specifics required to follow the agreement.

Table of Contents

This kind of template can help to ensure that both sides are in agreement and understand their obligations to protect both the employer and employee. By having a well-drafted template in place, employers can benefit from lower risk and handle lending to employees in a more efficient manner.

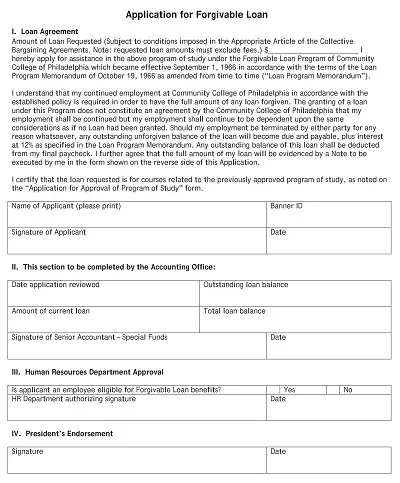

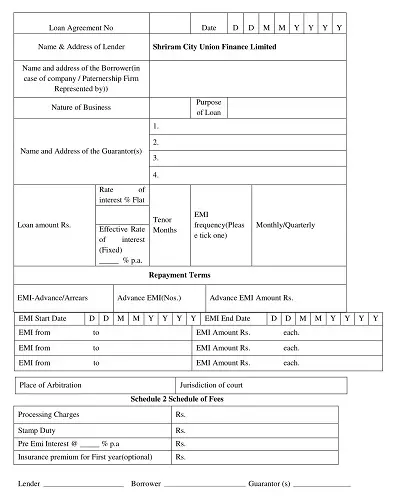

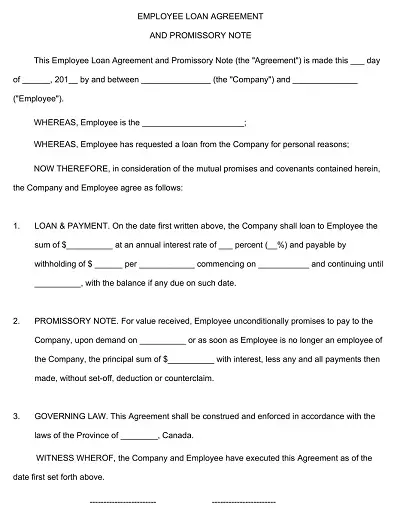

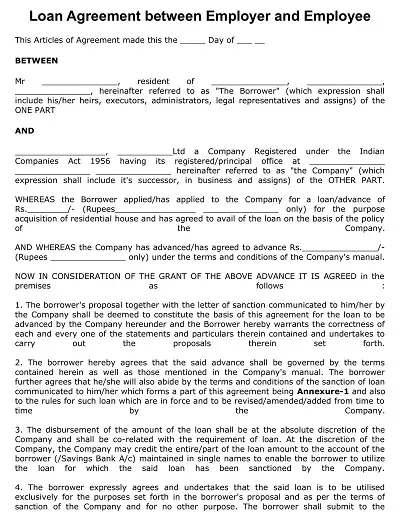

A loan agreement is an essential step for any financial contract. It serves as an enforceable document between a lender and borrower, outlining specific details about their arrangement. This agreement outlines who’s responsible for monthly repayments and when those payments are due, as well as the amount of interest to be paid on the loan amount and other applicable fees.

Furthermore, it also includes details about how and when the loan will be paid off. Having a loan agreement in place helps protect both parties in case of any misunderstandings or disputes that may arise and makes sure all aspects of the loan are clear and legally binding. In short, a loan agreement is the best way to ensure all parties involved know their obligations regarding the loan.

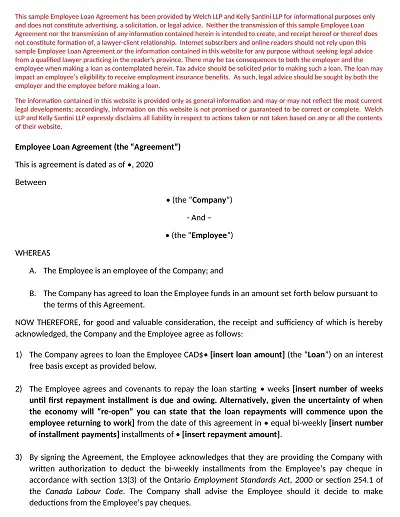

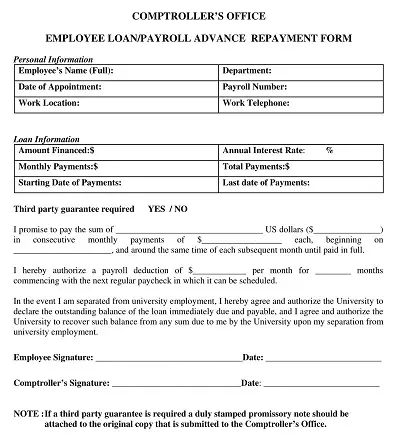

Ensuring employees receive fair terms when they borrow money from their employer is a must for businesses. Implementing legal requirements for employee loan agreements is vital to protect both the employer and employee from any potential liabilities that could arise. Informing the employee of all clauses and details of the loan agreement is paramount since it may impact their credit rating if the loan is not repaid promptly.

Employers should also ensure that all government regulations are met when issuing loans to employees, with particular attention paid to local and federal taxation matters, such as payroll deductions or income tax withholding. Following these steps will provide peace of mind for both parties, ensuring each can benefit without experiencing any negative consequences.

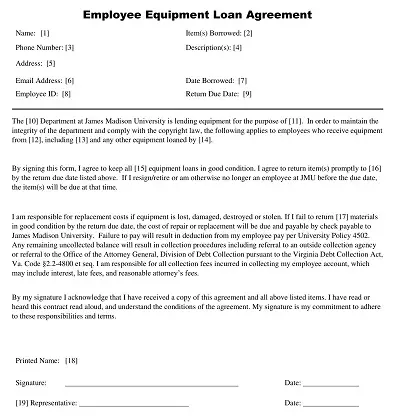

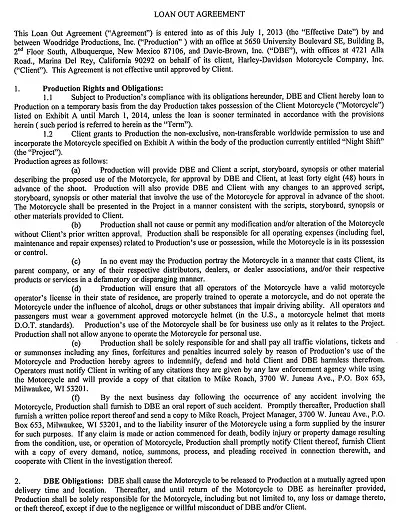

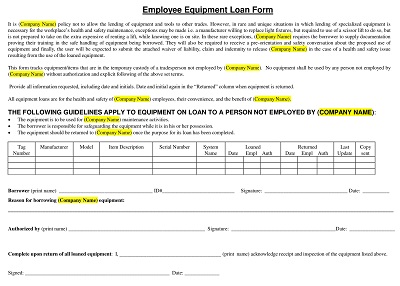

Employee loans are an effective way for companies to provide financial support to their employees. However, these loans come with their own set of terms and conditions that should be carefully read and understood before any agreement is made. These terms may include the amount of money being borrowed, repayment policies, interest rates, collateral requirements, and any additional charges associated with the loan.

Employees need to take the time to understand all of these terms before entering into a loan agreement, as failure to adhere can mean serious legal consequences. By working closely with their employers and ensuring they understand every detail of any employee loan policy, workers can enjoy the benefits of such agreements without any risk or stress.

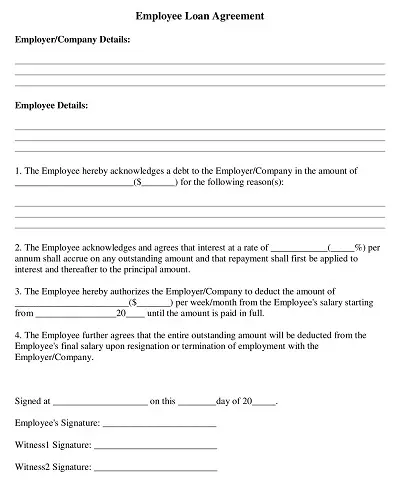

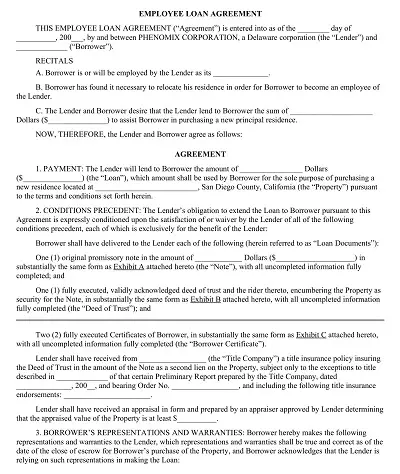

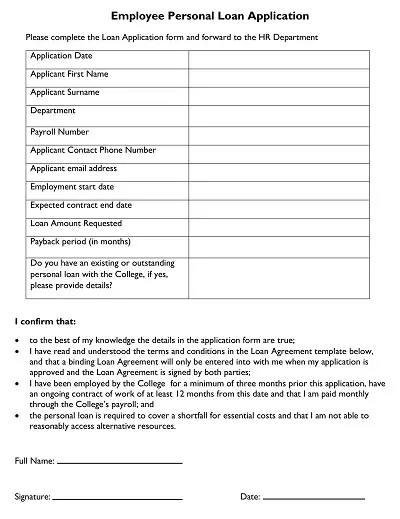

When you are running a business, it is important to have an employee loan agreement template in place. This document outlines the terms and conditions of any loans that you may offer your employees. It will include the loan’s interest rate, repayment schedule, and any other necessary information. Having a clear agreement in writing ensures that everyone is on the same page when it comes to loans. Here is how to create an employee loan agreement template for your business.

The first step in creating an employee loan agreement template is setting the interest rates and terms of repayment. Before you set a rate, be sure to research other loan providers to ensure that you are offering a competitive rate. Once you have determined what rate you will offer, make sure to clearly outline this information in your template so that it cannot be misinterpreted. You should also include information about the length of time over which the loan needs to be repaid and any late payment fees that may apply.

Another key element of your employee loan agreement template should be security requirements. This means outlining what assets or collateral can be used as security for the loan if necessary. For example, if you are offering a larger sum of money as part of a long-term loan, then you may want to require some form of security such as real estate or investments before approving the loan request. Again, make sure this information is outlined clearly in your template so there is no confusion later on.

Finally, it is important to include applicable laws related to employee loans in your agreement template. Since different states have different laws regarding loans and borrowing money from employees, make sure to research local regulations before including them in your template. Doing this will ensure that your business remains compliant with all applicable laws while still protecting both parties involved in the transaction.