Escape the last-minute rush of gathering rent receipts for your HRA exemption claim. Utilize Tax2win free rent receipt generator and maximize your tax savings effortlessly. It's fast, convenient, and easy to use.

Whether you're a landlord or a tenant, our user-friendly platform streamlines the process, ensuring accuracy and compliance every time. Simply input your details, and in just a few clicks, receive a customized rent receipt tailored to your specific needs.

For claiming HRA exemptions it is mandatory to submit Rent Receipts to the employer

This can be done by following 4 simple steps:-

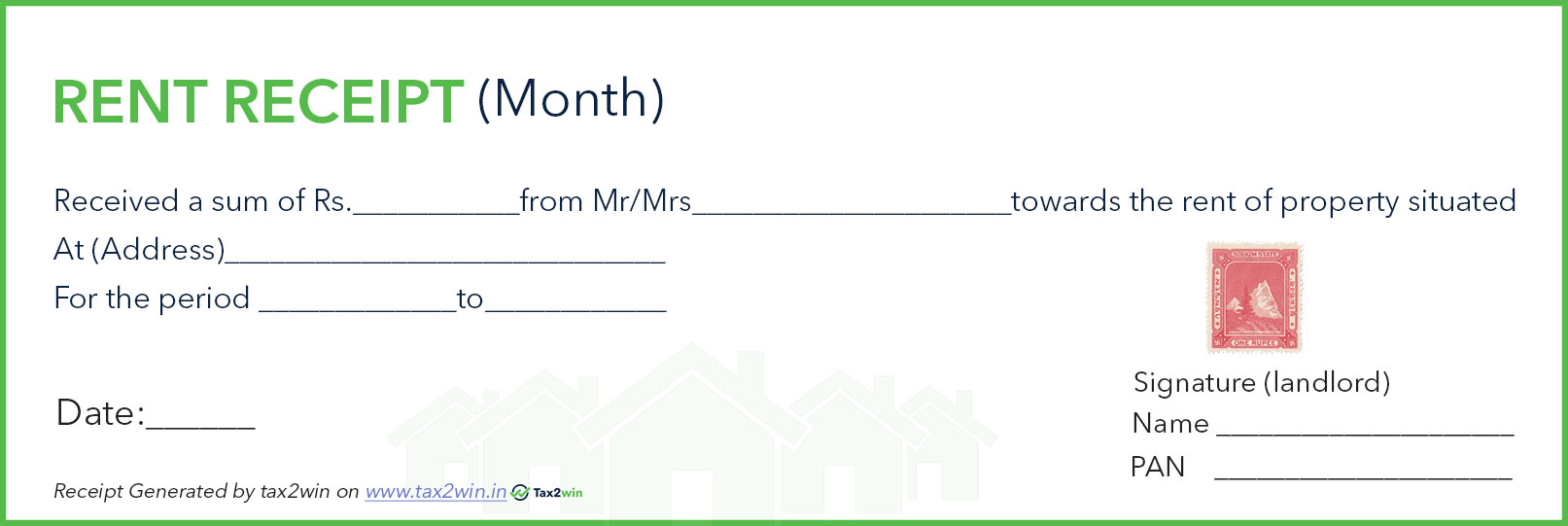

Sample Rent Receipt Template Format

Ready to Maximize Your HRA Deductions?Unlock Your Tax Benefits with Our Generated Rent Receipts!!

In India, a rent receipt is a crucial document that serves as proof of payment for the rent of a property. Its significance extends to various aspects, including income tax purposes, House Rent Allowance (HRA) exemptions, and maintaining accurate records of income and expenses. It is a key instrument for tax saving and so should be collected and kept safely. Salaried employees need rent receipts to claim their House Rent Allowance (HRA). The rent receipt(document) is provided by the landlord upon receiving the rent from the rentee, and his signatures are placed on it.

For claiming HRA exemptions it is mandatory to submit Rent Receipts to the employer

This can be done in just 3 simple steps

The following are the details which are required in the rent receipt:

A revenue stamp is required to be affixed on rent receipts if cash payment is more than Rs. 5000 per receipt. If rent is paid through cheque or online transfer then revenue stamp is not required.

You can easily understand it from the given table

| Mode of Payment | Whether revenue stamp is required |

|---|---|

| Cash, upto 5000 per receipt | No |

| Cash, more than 5000 per receipt | Yes |

| Cheque or online transfer | No |

Revenue stamps can be obtained from nearby post offices or you can obtain the same by stationery shops, amazon, local vendors.

It is mandatory to submit rent receipts or a copy of the rental agreement as proof for claiming a house rent allowance deduction. In India, individuals who are salaried and living in rented accommodation can claim House Rent Allowance (HRA) exemptions under Section 10(13A) of the Income Tax Act, 1961. The amount exempted is the least of the following:

By providing rent receipts, individuals can claim this exemption and reduce their taxable income, thereby saving on taxes. The exact amount saved will depend on the individual's salary, rent paid, and other applicable factors.

Need help in tax planning and want to maximize your tax savings, know where you should invest your hard earned money. Consult with the tax experts.

To calculate your HRA exemption use our free calculator or Read more.