Hysterectomies are a popular healthcare procedure among women in the United States. According to the CDC, 1 in 3 women will undergo a total hysterectomy by age 60. A hysterectomy is a procedure in which surgeons remove a woman’s uterus. The surgery is usually performed to help treat specific health conditions.

Surgeries like this can be expensive, so proper insurance coverage is critical. The Medicare program helps cover the costs of costly procedures like this. Let’s find out who qualifies and how Medicare covers a hysterectomy.

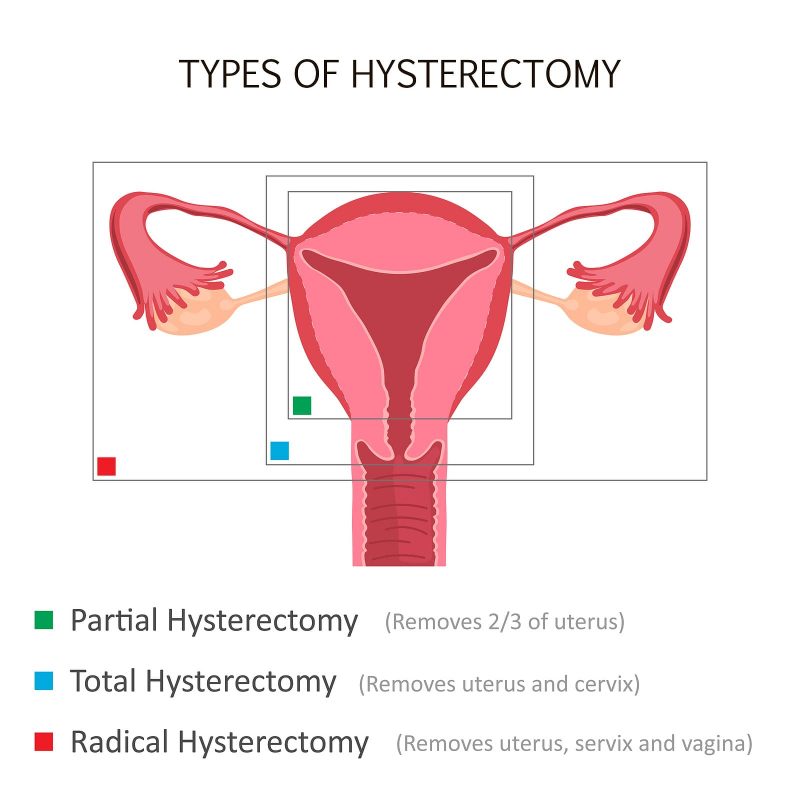

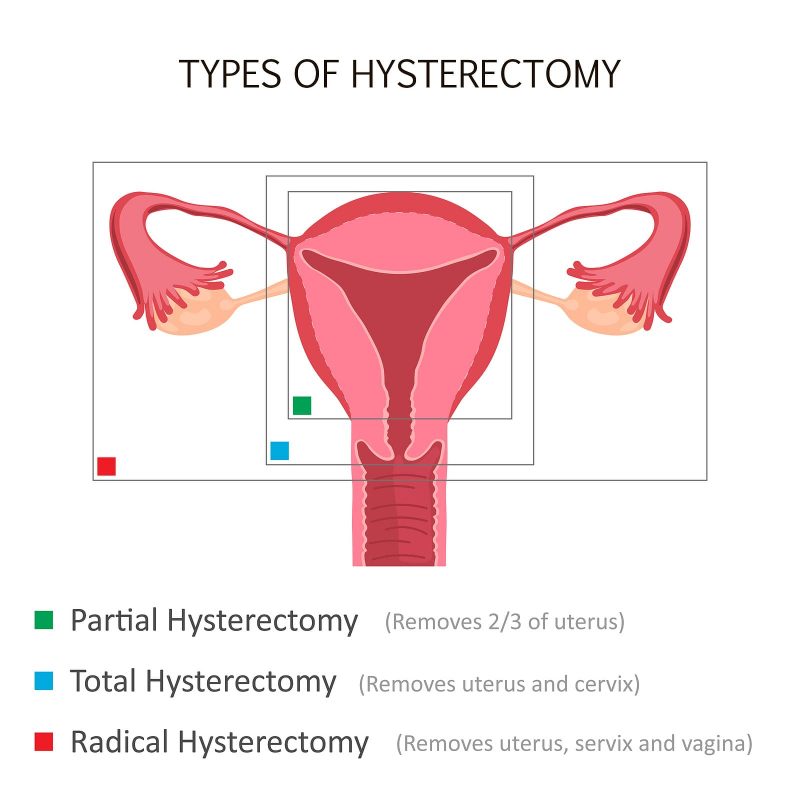

A hysterectomy is a procedure in which your doctor removes the uterus. Sometimes, your doctor may even need to remove your Fallopian tubes and ovaries. Hysterectomies can come in a couple of different forms:

Total Hysterectomy: The entire uterus and cervix get removed.

Partial Hysterectomy: Only a part of the uterus is removed, and the cervix isn’t operated on.

Hysterectomies involve removing either one or both ovaries, and the surgeries can be done in a few different ways.

Abdominal Hysterectomy – The removal of the uterus from an incision in the lower abdomen.

Vaginal Hysterectomy: Uterus gets removed through a vagina.

Laparoscopy Hysterectomy: A laparoscope displays camera images through an incision around the belly button. Small incisions are then made through the abdomen to complete the surgery.

Like many other surgical procedures, there can be several reasons why a doctor would want to perform a hysterectomy on a patient. Endometriosis, cancer, and uterine fibroids are some of the most common culprits. Many women require a hysterectomy because of abnormal vaginal bleeding. Some women may need the surgery because of chronic pelvic pain or a prolapse, while others seek elective hysterectomies to prevent pregnancy. Either way, hysterectomies are one of the more popular procedures performed in this day and age.

When you hear the news from your doctor that you need a hysterectomy, it can understandably come as a shock. Not only will you undergo surgery, but you’ll need to make sure you can afford the surgery. Medicare will cover the procedure if your doctor deems the hysterectomy medically necessary.

Medicare Parts A and B will help to cover medically necessary hysterectomies. Likewise, a Medicare Advantage policy will also help cover these surgery costs. Elective hysterectomies aren’t covered through Medicare.

While it’s true that Medicare can cover quite a bit, it doesn’t necessarily cover every health issue. If Medicare Parts A or B don’t cover the procedure you need, you’ll have to pay out-of-pocket for the services. Medicare will cover most surgeries that could result in a significant decline in health if the surgery isn’t performed.

But it won’t cover cosmetic surgeries. Cosmetic surgeries are procedures in which a portion of your appearance is changed. Cosmetic dentistry, Botox, and Breast Augmentation are just a few cosmetic surgeries that aren’t covered through Medicare.

One of the most crucial aspects of preparing for a surgical procedure is factoring in the cost. The average price of a hysterectomy surgery without insurance can range from around $8,630 – $11,483. Of course, this depends on what type of hysterectomy you undergo.

You’ll need to pay your Medicare Part A deductible if you have a hysterectomy in an inpatient setting. The Part A annual deductible in is $1,632. An outpatient hysterectomy falls under your Part B coverage. Part B pays 80 percent of the expenses after you meet your Part B deductibles, leaving you to pay 20 percent of the procedure costs.

Costs will vary depending on your secondary coverage. Beneficiaries enrolled in a Medicare Supplement plan may have little to nothing to pay out of pocket. In contrast, those on Medicare Advantage plans will pay the cost-sharing outlined by their plan.

Since Medicare will only cover hysterectomies deemed medically necessary, what does this mean? Your doctor will need to find that if your uterus isn’t removed, your health and life may be in danger. In situations where your health deteriorates immensely, and medications and alternative treatments don’t work, you may have a hysterectomy and receive coverage through your Original Medicare.

For example, cancer of the cervix or Fallopian tubes would be deemed necessary. Extensive bleeding that’s unmanageable with other health treatments may also be ruled as necessary. Even cases of endometriosis may be considered necessary if the condition is bad enough.

As with any major medical procedure, consider the side effects before surgery. In most cases, side effects should only be short-term. However, there’s always a possibility of enduring long-term side effects.

Immediately after your surgery, you may deal with the pain while in the hospital. For the first couple weeks following your surgery, you may notice bruising or swelling where your surgery was performed. You may also deal with hot flashes, night sweats, or even insomnia, as hysterectomies bring on menopause, and you’ll no longer have a period. Long-term effects may include:

Hysterectomies will jumpstart menopause for ladies of all ages. Vaginal dryness is another side effect that often accompanies a hysterectomy. Medicare Part A and Medicare Part B help cover specific medications, such as the medicine you may receive following your surgery while in the hospital.

However, Part A and Part B won’t cover prescriptions for menopause or vaginal dryness. You’ll want to look into getting Medicare Part D drug coverage. Beneficiaries can buy this prescription coverage through a private insurance carrier. Make sure to call the insurance company to confirm coverage and costs with your Part D plan to ensure your medications will be covered.

Do you still have questions about Medicare and hysterectomies? Here are some of Medicare beneficiaries’ most common questions regarding this surgery.

Medicare Advantage plans cover all that Original Medicare covers. Of course, it’s always best practice to call and speak directly with your insurance company to avoid unexpected complications.

Of course, hospital time depends on many factors. Your overall health, age, and condition significantly affect hospital stays. Another factor would be the type of hysterectomy you have. A laparoscopic hysterectomy may not even require you to stay in the hospital, or you may need only to stay for a day or two. Abdominal hysterectomies may keep you in the hospital for up to five days.

In most cases, the typical hysterectomy recovery time is around 6 – 8 weeks.

Surgeries can be expensive. Don’t get caught up in an endless cycle of medical bills to pay for your much-needed surgery. Medigap plans help fill in the gaps between paid and unpaid medical expenses.

We have an experienced team of Medicare specialists to help answer your questions and compare the best prices and supplemental insurance on the market. Call us, or complete an online rate form today.

Written By:

Lindsay Malzone, Lindsay Malzone is the Medicare editor for Medigap.com. She's been contributing to many well-known publications since 2017. Her passion is educating Medicare beneficiaries on all their supplemental Medicare options so they can make an informed decision on their healthcare coverage.

Reviewed By:Rodolfo Marrero, Rodolfo Marrero is one of the co-founders at Medigap.com. He has been helping consumers find the right coverage since the site was founded in 2013. Rodolfo is a licensed insurance agent that works hand-in-hand with the team to ensure the accuracy of the content.

Get a FreeA+ Rating More than 3 million customers served since 2013.

medigap.com is privately owned and operated by Excel Impact, LLC. Invitations for applications for insurance on medigap.com are made through Flex Rates, LLC, a subsidiary of Excel Impact, only where licensed and appointed. Flex Rates licensing information can be found here. Submission of your information constitutes permission for a licensed insurance agent to contact you with additional information about the cost and coverage details of health plans. Descriptions are for informational purposes only and subject to change. Insurance plans may not be available in all states. For a complete description, please call (TTY Users: 711) to determine eligibility and to request a copy of the applicable policy. medigap.com is not affiliated with or endorsed by the United States government or the federal Medicare program. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Not all plans offer all benefits. Availability of benefits and plans varies by carrier and location. Deductibles, copays and coinsurance may apply. Limitations and exclusions may apply. Participating sales agencies represent Medicare Advantage [HMO, PPO and PFFS] organizations and stand-alone PDP prescription drug plans that are contracted with Medicare. Enrollment depends on the plan’s contract renewal. We do not offer every plan available in your area. Currently we represent [73] organizations which offer [5110] products in your area. Please contact https://Medicare.gov , 1–800–MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options. The purpose of this communication is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Enrollment in a plan may be limited to certain times of the year unless you qualify for a special enrollment period or you are in your Medicare Initial Election Period. By using this site, you acknowledge that you have read and agree to the Terms of Service. and Privacy Policy.

We are committed to protect your privacy. If you do not want to share your information please click on Do Not Sell My Personal Information for more details.

Copyright © 2022 Medigap.com | All rights reserved | 382 NE 191st Street, Ste 57537, Miami, FL 33179.

United States

Copyright © 2022 Medigap.com. All rights reserved.